The Income Tax Act, of 1961, has certain sections which deal with tax concessions and benefits allotted to differently-abled individuals. Section 80DD and Section 80U prescribe various instruments, expenditures, and investments that can help a differently-abled individual or their guardian/s receive tax benefits. One can get an estimate of the extent of these benefits with the […]

5 Best Tips for Students to Acquire a Personal Loan

A personal loan is highly beneficial for students. The leading banks offer lower interest rates starting at just 10.49%. The money can be used for multiple purposes like a higher course, an international degree, study materials or for paying off education loan debts. A portion of the loan can fund your living expenses in the […]

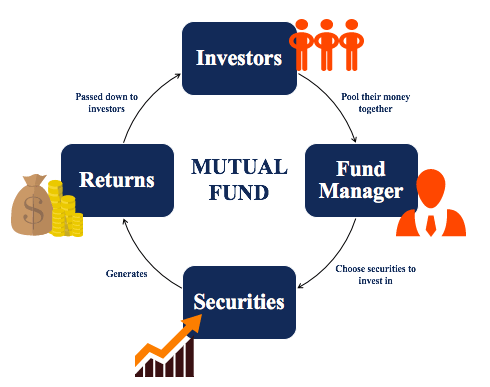

Benefits Of Investment In Minor’s Name

Most parents constantly look for investment avenues that could help them financially secure their child’s future. Through such investment, they look to build a sizable corpus to help them pay for the higher education needs of their children. Investing in mutual funds for children to cater to expected future expenditures is a popular option. A […]

How to activate cancelled GST Registration

GST i.e., Goods and Services Tax India has indeed been one of the most significant reforms that helped replace all the other taxes that were applicable in various scenarios, like VAT, Service Tax, Octroi, Central Excise, Entry Tax, etc. All businesses require a GST number from the state they are registered in, as both the […]

How to conduct fundamental analysis of stocks to make smart investment decisions?

There are many ways to select a stock. An investor can go by word of mouth, trends, or do a proper analysis called fundamental or basic analysis on the financial level and take a look at the key ratios of a company to understand whether the company is financially healthy. In technical terms, fundamental analysis […]